Acquisitions as catalysts for inventor departures in the biotechnology industry

Humanities and Social Sciences Communications (2025)

with Luca Verginer, Federica Parisi, Jeroen van Lidth de Jeude and Massimo Riccaboni

DOI Link Bibtex

Abstract

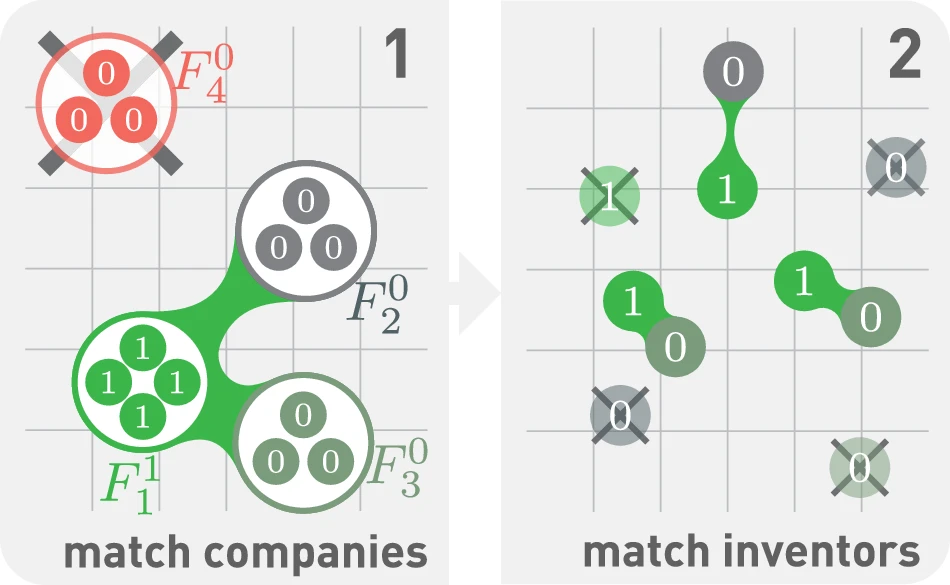

AB - In high-tech industries, where intellectual property is crucial, the acquisition of intangible assets and tacit knowledge of employees is one of the main motivations for Mergers and Acquisitions (M&As). The takeover wave in the biotechnology industry in the 1990s following the molecular biology revolution is a well-known example of how M&As were used to absorb new knowledge. However, after an M&A, it is uncertain whether key R&D employees who embody valuable knowledge and potential future innovations can be retained. Even if not all employees are relevant to the success of the acquisition, inventors are among the most valuable. This is especially true when acquiring an innovative startup. In this paper, we estimate how likely it is that an inventor working for an acquired biotechnology company will leave. Using a difference-in-differences approach with matching for both firms and inventors. We find that inventors affected by acquisitions are 20% more likely to leave the company. Our results contribute to the current debate on acqui-hiring of high-tech startups.